30+ construction loan vs mortgage

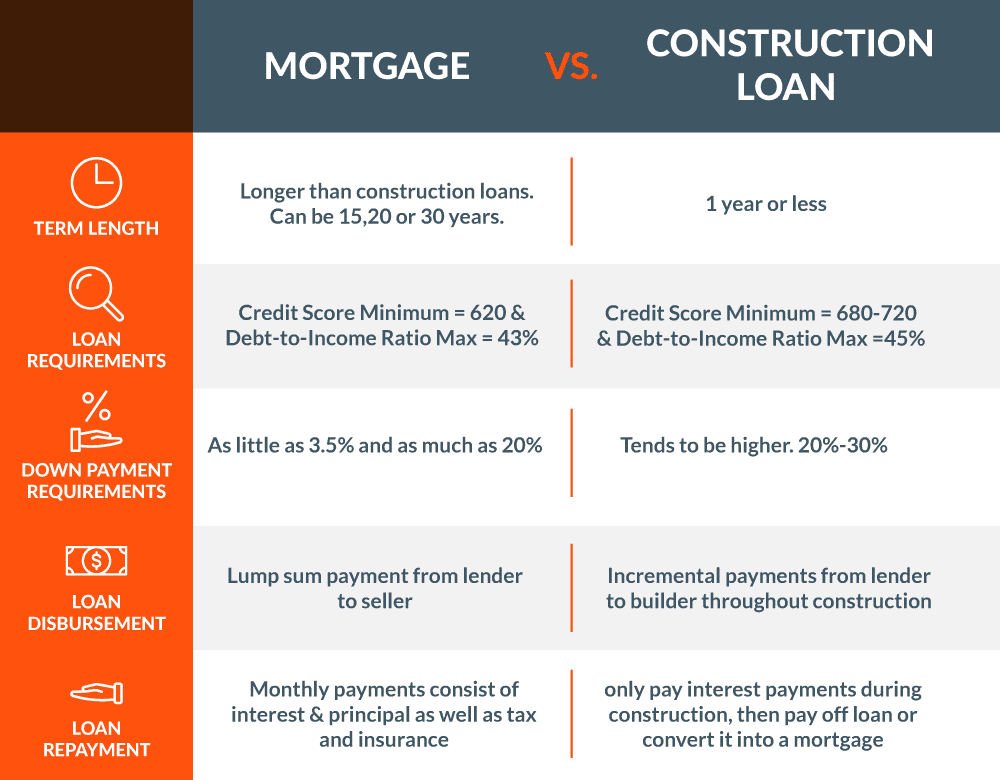

Web Construction Loans typically require a larger down payment than traditional mortgage loans and the interest rates tend to be higher as well. Web 15-year fixed-rate mortgages.

Buy A House Lisa Legrande Mortgage Loan Officer

A 30-year loan may be the most common but homebuyers have the option of selecting shorter.

. Web Lets say youve drawn or borrowed 50000 of your 400000 construction loan. On the flip side construction. Compared to a 30.

Web A typical mortgage has a 30-year term during which the borrower must repay the principal loan amount as well as the interest charges. Web Mortgage lending allows you to borrow money from lenders in exchange for a portion of your assets value. Web On the other hand a Construction Loan pays out a certain amount throughout specific stages of the build.

The interest rate on your construction loan is 6 percent. Web Construction loans have much shorter terms than conventional mortgages. Web The average 30-year fixed-mortgage rate is 708 percent an increase of 7 basis points since the same time last week.

Down payments for a standard mortgage can be relatively low with some requiring as little as 35. Web When deciding between getting a mortgage or a construction loan its important to consider your financial situation and long-term goals. Web Construction loan interest rates are typically higher than mortgage loan rates because they carry more risk for the lender particularly while the home is being.

A mortgage is a long-term loan that is used to finance the. Another difference between a construction loan and a standard mortgage is that the loan pays out as progress is made on the. Web While each type of financing itself has many variables there are a few general principles that largely hold true.

Web Construction loans require a larger down payment. The average rate for a 15-year fixed mortgage is 630 which is a decrease of 1 basis point from seven days ago. This is because the lender has the security of your home as.

Web The main advantage of a mortgage is that it offers a lower interest rate than a home construction loan. A month ago the average rate on a 30-year fixed. Web The average 30-year fixed-refinance rate is 709 percent down 10 basis points compared with a week ago.

The average rate for a 15-year fixed mortgage is 628 which is a decrease of 5 basis points compared to a week ago. Web 15-year fixed-rate mortgages. Web A construction loan is a short- term loan that is used to finance the construction of a home.

Mortgage lending is perfect for companies who want to. Web Construction loans are disbursed in phases. A month ago the average rate on a 30-year.

Web A construction loan is short-term financing that can be used to cover the costs associated with building a house from start to finish. Construction Loans Are Shorter. In addition during the.

30 Loan Application Forms Jotform

Recently Funded 350k Construction Completion Bridge Loan With 2nd Lien Greenwich Ct

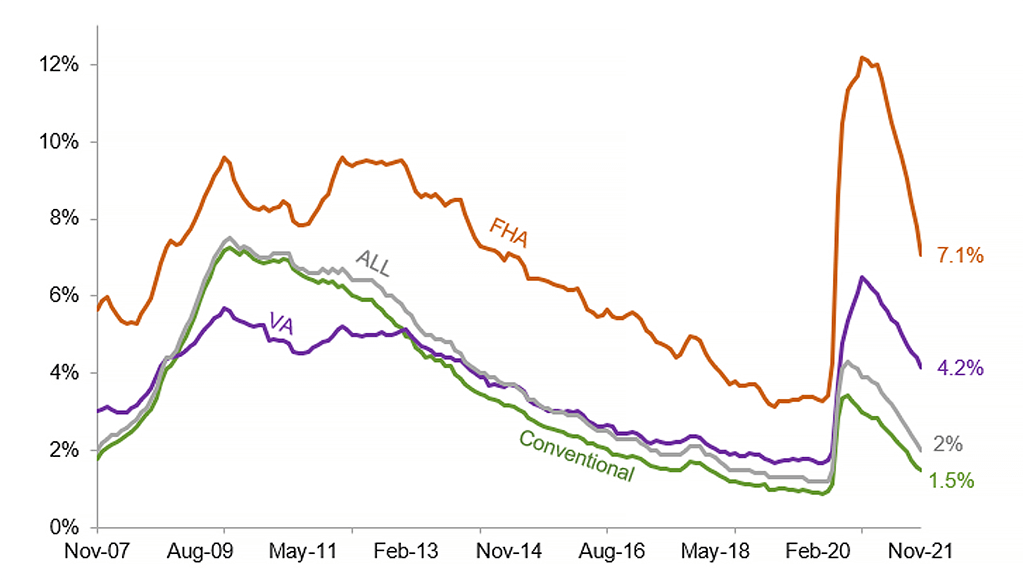

Serious Delinquency Rate For All Mortgage Loan Types Down From Last Year Corelogic

Mortgage Brokers 101 Loan

What S The Difference Between A Construction Loan And A Mortgage Loan

Summit Credit Union

Construction Loans Vs Conventional Loans Ridgeline Homes Llc

Mortgage Broker Harrington Better Loan Rates Mortgage Choice

Construction Loan Rate Vs Permanent Loan Rate Sapling

Mortgage Lender Woes Wolf Street

Temporary Rate Buydown Calculator Walter Mackelburg Mortgage Loan Officer

Case Study Homeside Financial Landgorilla

30 Loan Application Forms Jotform

Mortgage Lender Woes Wolf Street

Mortgage Lender Woes Wolf Street

Mortgage Lender Woes Wolf Street

2 Basic Financing Options Mortgages Vs Construction Loans